5 Canadian Companies with Top Fintech Marketing Strategies

Instagram isn’t only for travel and fun. There are no limits to great marketing opportunities that a business can generate through carefully calibrating their digital marketing strategy. In particular, Instagram is an essential part of fintech marketing strategies. Increasing engagement, connecting with your target audience, driving traffic to your website and fostering customer loyalty, is all possible when you have a captivating Instagram social feed.

With over 1 billion active users in 2020, Instagram is already an essential part of a successful digital marketing strategy. According to Sprout Social, approximately 80% of users admit to using this platform to help them discover new products and services. Moreover, the Instagram profile of a business can directly influence the purchase decisions of modern consumers. With more and more brands recognizing Instagram as a powerful tool, many fintech companies are also fine-tuning their social media feeds.

The number of fintech companies in Canada continues to rise, with Canadian fintech adoption rate reaching an all-time high of 50% in 2019. Luckily, Instagram is an easy marketing strategy for fintech startups looking to engage and inform their audience and establish a unique brand presence. If you are lacking inspiration for your profile or are still not sure about Instagram as a platform, take a look at these top fintech companies who are currently #killingit with their Instagram game.

Wealthsimple @wealthsimple

Let’s start off with Wealthsimple. This Canadian company takes online investment to a whole new level. Specializing in rebalancing, dividend reinvestment and tax loss harvesting since 2014, Wealthsimple has allowed individuals to “do more with [their] money”.

Besides their exceptional success, Wealthsimple has also developed a digital marketing strategy on Instagram that is consistent, clean and original.

- Their page features a good balance of videos and photos, allowing users to stay engaged.

- The use of pastel colours throughout their page creates a visual consistency.

- Quirky and unique graphics instantly capture visitor attention.

- The use of contextual posts is also a great visual learning tool that makes finance much easier to understand.

- User illustrations provide unique stand-points on finance.

Borrowell @myborrowell

Borrowell is a Toronto-based company that allows customers to monitor their credit score for free, with the simple use of their application. In fact, they are the first company to offer this feature and now have over 1 million members.

- Their fintech branding is consistent throughout the entirety of their page. From the use of its colours to the graphics, the team has created a distinct profile that separates them from competitors.

- Borrowell does an exceptional job of implementing their connected posts. A series of separate posts, when combined together on the feed, make up a bigger picture. This tactic is a great way to turn your Instagram profile into a work of art.

- Their “tips to stay on track” posts are also a helpful addition to their page. These useful pointers are ideal for their followers as it allows them to consistently gain new financial insights.

- Borrowell also has posts that target specific user groups, including prospective employees. This again allows users to grasp and learn about them as a company and possible career opportunities.

KOHO @getkoho

KOHO is all about helping others save money while getting rid of credit card interest and unexpected bank fees. Their modern take on finance is “designed to help you live a better life”. With KOHO, you can earn cashback, make purchases by loading money, and build savings all with one credit card.

Their Instagram social media strategy is the definition of relatable. With their unique posts and captions, they have undoubtedly created a strong online presence.

- They have a colourful brand that is consistently carried forward on their feed.

- They have used their products creatively and visually. Their posts of customers using a KOHO card to make purchases showcase the brand’s strong aesthetics.

- KOHO uses creative graphics and designs to represent complex topics like financial balance.

- Their captions often include a youthful tone and emojis that can easily resonate with their target audience. This also adds to the relatable factor that allows their followers to connect with them.

Sensibill @getsensibill

Sensibill is another innovative company that helps with managing your receipts. With the simple use of their mobile application, customers are now able to control their purchases and their finances with Sensibill. This fintech startup has experienced great success and are not afraid to show their ins-and-outs.

- Sensibill is all about showing off their team and making them the heroes of their social game. Their frequent posts of the people behind Sensibill allow viewers to better understand the company and how they came about.

- Career opportunities and company events are also often displayed on their feed. This is great as it allows users to become aware of recent openings and opportunities to meet the team in real life.

- A unique treatment to all their posts created a consistent look to their page. The use of the brand colours, fonts and images creates a visually appealing feed.

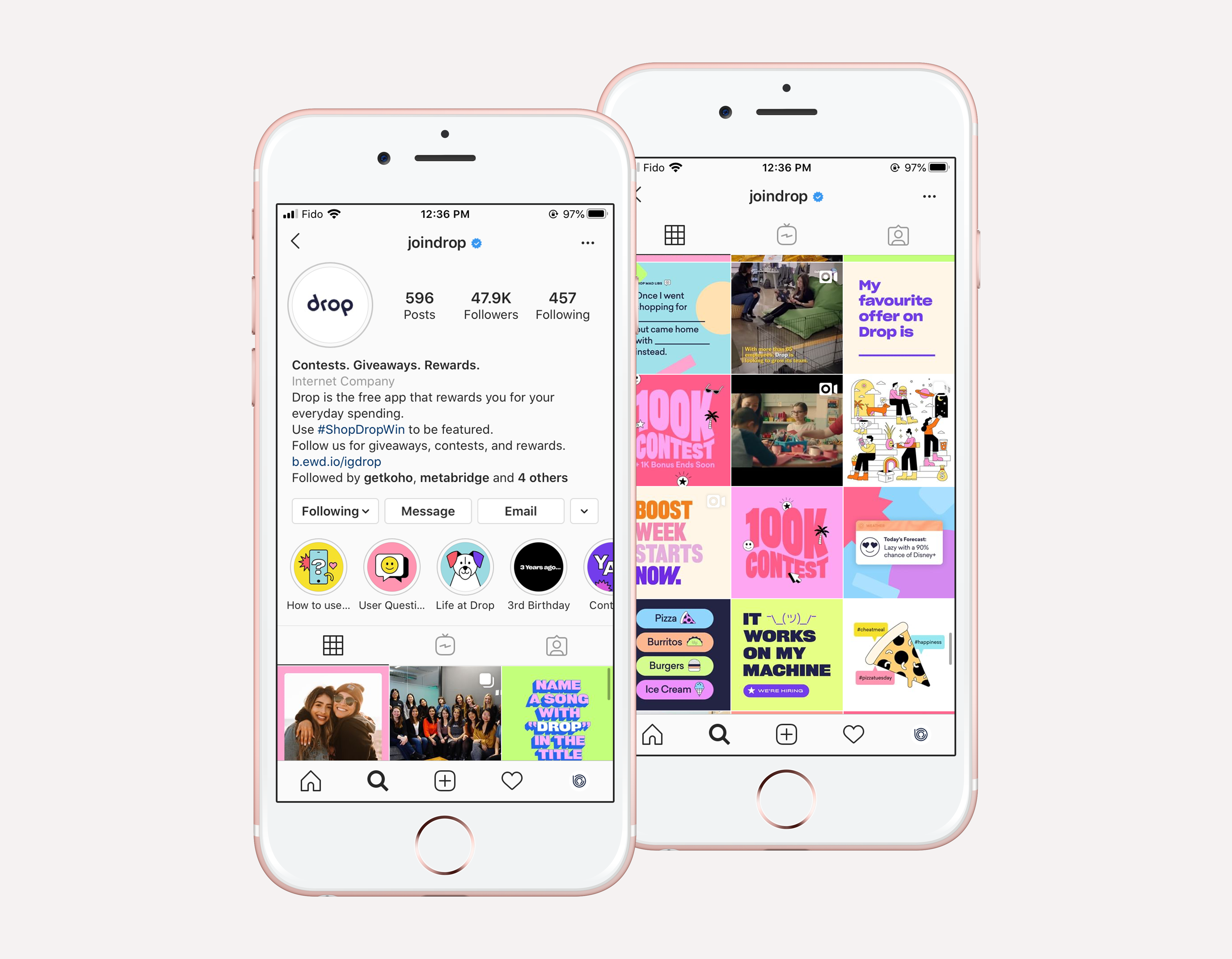

Drop @joindrop

Drop is the ultimate mobile rewards platform. Instantly earn points while shopping? We’re here for it. Their unique application is simple, easy to use, and free. Simply link your debit or credit card and redeem points on select brands (1,000 points = $1.00).

Drop’s social feed on Instagram is the definition of fun.

- Their Kitsch style and the use of a warm theme for graphics make their page a fun-filled platform with colours that immediately catch the eye.

- Their witty text and captions are noteworthy. Drop brings wit and colour to fintech.

- Contests and reward programs are well-leveraged to increase engagement with their followers. 20,000 free drop points? Sign us up!

Beyond the feed

You should also keep in mind that the quality of your Instagram feed goes beyond the aesthetics. Maintaining a high follower/following ratio is key to ensure that you’re considered a “high-quality account”. Let’s examine a little further on how to promote fintech online.

As a business, you want to have a good online reputation. To be considered credible, you want viewers to see that the number of followers is bigger than the number of people you are following. Tip: aim to have a ratio bigger than 1 – the higher the better. To calculate the follower/following ratio simply divide your followers by the accounts followed.

If you take into consideration the five fin-tech companies mentioned above, Wealthsimple is killing the ratio game. Even though all the accounts have a ratio greater than 1, Wealthsimple’s ratio is currently 908.57, with 31.8k followers and 35 following. This is what you want to have – a page where visitors see that your account is interesting to follow.

Instagram stories are another feature to keep in mind. Instagram social posts no longer appear in chronological order. Instead, posts appear on feeds depending on factors like engagement and likes. To allow your business to stay on top of the game, you should implement stories as a way of increasing your engagement.

Stories are ideal as they help maintain visibility to your followers and create a more credible page. Drop and KOHO regularly post stories and save them on their feed. They currently have nine and seven story categories respectively. Saving your stories is great as it allows new viewers to refer back to what they’ve missed. Drop and Wealthsimple also take it a step further by implementing IGTV, which is designed for long-form videos where content can last up to one hour. Again, you are able to save these to your feed for future reference.

From keeping a visually appealing Instagram feed to balancing the follower-following ratio, digital marketing for fintech companies does not come easy. Wealthsimple, Borrowell, KOHO, Sensibill and Drop are great examples of successful social media marketing strategy, and remind us that the future of Canadian fintech is brighter than ever.

Want to chat about strengthening social marketing strategies? Reach out to our Senior Partner Caren at caren@benjamin-david.com.