- year 2019

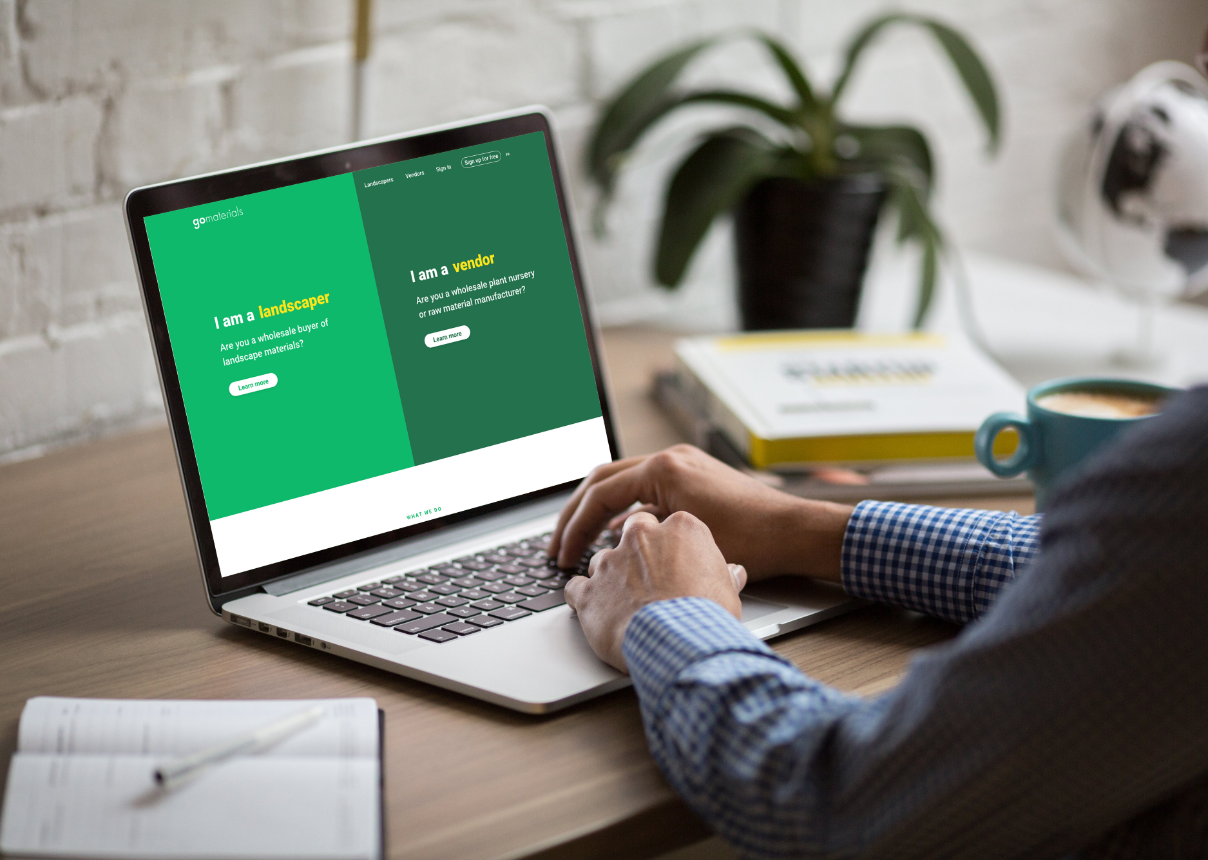

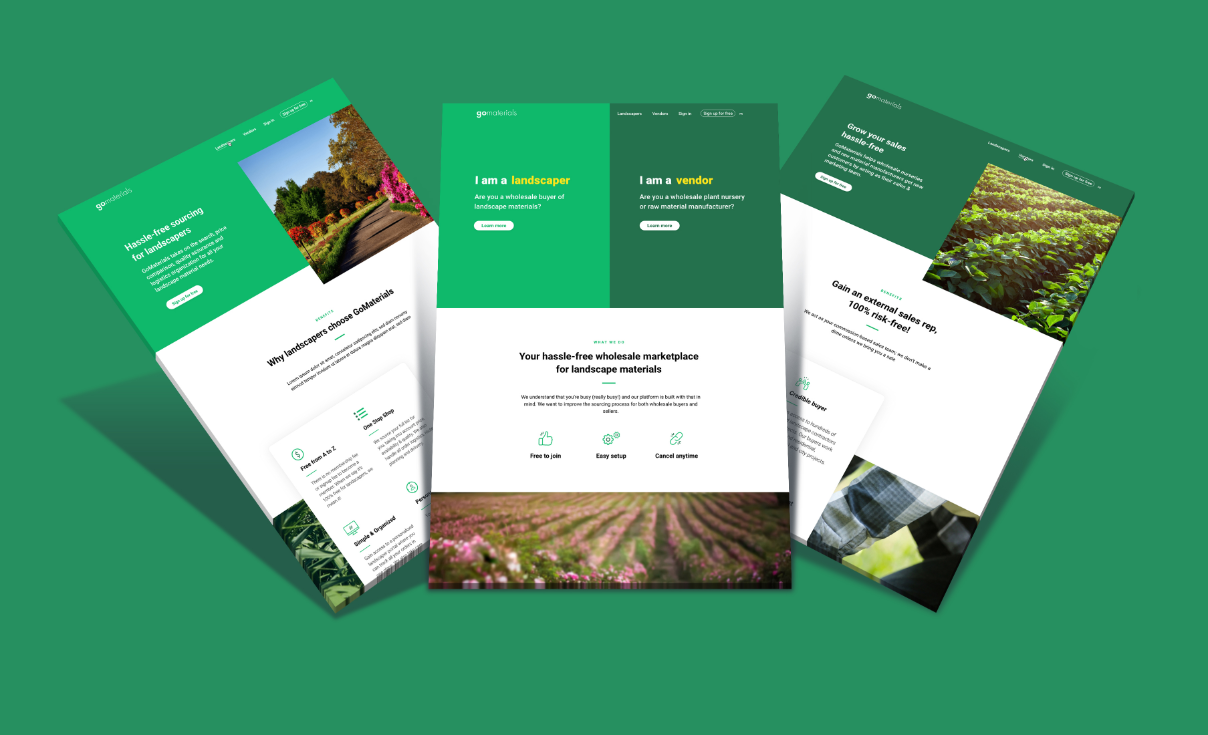

- Client GoMaterials

- Project Investment & Advisory

- industry ConTech

About GoMaterials

GoMaterials is a B2B marketplace selling landscape materials through their network of partnered vendors. Their one-stop-shop meets all landscaper procurement needs, from vendor quoting and price comparisons, ordering, delivery logistics and invoicing.

challenge

We met GoMaterials in 2017 when 2 of the 3 co-founders were moonlighting sales outside of their corporate jobs.

Marc Elliott, the founder & CEO, had previously sold his successful landscaping business and had a strong network of contacts in Montreal; giving them early and respectful revenue traction. Even though their technology was near non-existent, they were creating real value for landscapers by optimizing the procurement and delivery process.

We saw a ton of potential, especially as everything had been bootstrapped and self-funded to date, but there were some gaps that needed to be closed before we could commit. One of our primary concerns was the drastic seasonality of the Montreal landscaping market, and if they could build demand in a new market without pre-existing contacts.

plan

01.

Head south

We strongly encouraged them to open up Florida as their next market. This would keep the selling season open much longer, generate revenues in $USD and prove their ability to open a new market without existing contacts.

02.

All In

The team needed to be fully committed to GoMaterials - which meant dedicating their full attention and leaving their corporate jobs.

03.

Integration

We constructed a deal that would combine capital and sweat equity. We wanted to leverage our team of marketing specialists to provide the GoMaterials leaders with the right growth tools and advice they needed.

bdg process

In-Office Support

We invited the GoMaterial team (4pax) to work from our office for the first 6-9 months of our engagement. This was a key ingredient that helped bond the teams.

Dedicated time with Specialists

The sweat-equity was diligently managed and time was allocated amongst the team of BDG specialists, ensuring the GoMaterials team had access to a 360-suite of services

B2B Lead generation

Pressure was on to get Florida up and running. We helped the GoMaterials team set up a B2B lead generation strategy that enabled them to secure a client-base and generate revenue within 30 days.

Avoiding pitfalls

When marketing a young business, paid media is often a first thought as an acquisition channel but there are many other less glamorous strategies that could yield better results. We helped guide the team through the options and advised when and where best to spend.

the outcome

700%

Traction - 700% growth in 2 years

The team moved out of our office, expanded their footprint in the US, and continue to set record revenue months. With Florida and other US states gaining more and more market share, the seasonality pitfalls have been near eliminated.

Team - Staying Resourceful

While it’s hard not to be tempted to try to raise VC money, we had experience coming out of a self-funded startup so we advised them to stay lean until they had the right recipe. Their resourcefulness and ability to make a dollar stretch is a rare talent in early stage companies

Technology - Machine learning tech stack

As part of our sweat equity arrangement, we were able to transfer some of our efforts to our development partners; Hesper technology. Hesper brought their A-team of developers to the table and are helping GoMaterials optimize and automate a large component of their procurement process.

TAM

The ConTech industry is skyrocketing, and changing fast. Investment in ConTech topped $6 Billion in 2019, up 100% from 2018. By continuing to guide and surround the GoMaterials with the right partners, we are helping position them be a leader in the space.

summary

By focusing on sales, marketing, an mvp, not chasing VC money too early and growing into their solution, GoMaterials was not only able to build a break-even business model, but invest in an advanced tech-stack and build up their value without early dilution.

The story has really just started for GoMaterials, and BDG continues to be an active advisor.